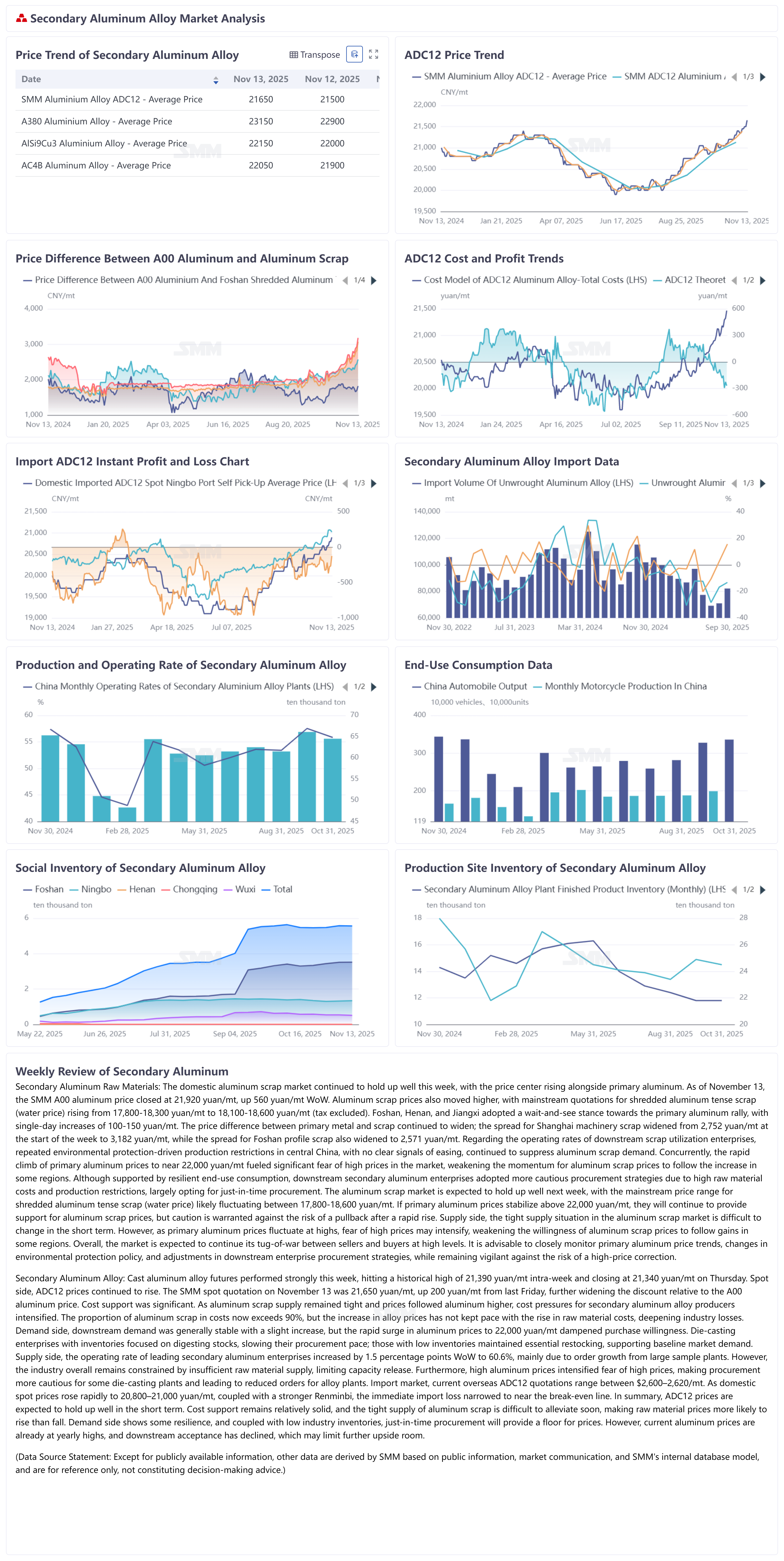

Domestic aluminum scrap market continued to hold up well this week, with the price center rising alongside primary aluminum. As of November 13, the SMM A00 aluminum price closed at 21,920 yuan/mt, up 560 yuan/mt WoW. Aluminum scrap prices also moved higher, with mainstream quotations for shredded aluminum tense scrap (water price) rising from 17,800-18,300 yuan/mt to 18,100-18,600 yuan/mt (tax-exclusive). Buyers in Foshan, Henan, and Jiangxi adopted a wait-and-see stance towards the primary aluminum rally, with daily increases of 100-150 yuan/mt. The price difference between primary metal and scrap continued to widen. The price difference between A00 aluminum and machine-cut aluminum tense scrap in Shanghai widened from 2,752 yuan/mt at the start of the week to 3,182 yuan/mt, while the price difference for aluminum profiles in Foshan also widened to 2,571 yuan/mt. On the operating side of downstream scrap utilization enterprises, repeated environmental protection-driven production restrictions in central China, with no clear signals of easing, continued to suppress aluminum scrap demand. Meanwhile, the rapid climb of primary aluminum prices to around 22,000 yuan/mt fueled significant fear of high prices in the market, weakening the momentum for scrap prices to follow the rise in some regions. Although supported by resilient end-use consumption, downstream secondary aluminum enterprises became more cautious in procurement due to high raw material costs and environmental restrictions, mostly adopting a "just-in-time procurement" strategy. The aluminum scrap market is expected to hover at highs next week, with mainstream prices for shredded aluminum tense scrap (water price) likely fluctuating within the 17,800-18,600 yuan/mt range. If primary aluminum prices stabilize above 22,000 yuan/mt, they will continue to support scrap prices, but caution is warranted against a potential retreat after a rapid rise. Supply side, the tight supply situation in the scrap market is unlikely to change significantly in the short term. However, as primary aluminum prices fluctuate at highs, fear of high prices may intensify, weakening the willingness for scrap prices to follow the rise in some regions. Overall, the market is expected to continue its tug-of-war between sellers and buyers at high levels. It is advisable to closely monitor primary aluminum price trends, changes in environmental protection policies, and adjustments in downstream procurement strategies, while remaining vigilant against high-price pullback risks.

Cast aluminum alloy futures performed strongly this week, hitting a record high of 21,390 yuan/mt during the week and closing at 21,340 yuan/mt on Thursday. In the spot market, ADC12 prices continued to rise. The SMM spot quotation on November 13 was 21,650 yuan/mt, up 200 yuan/mt from last Friday, further widening the discount against the A00 aluminum price. Cost support remained significant. As aluminum scrap supply stayed tight and prices followed aluminum higher, cost pressures for secondary aluminum alloy producers intensified. Aluminum scrap now accounts for over 90% of costs, but the increase in alloy prices has lagged behind the rise in raw material costs, deepening industry losses. Demand side, downstream demand was generally stable with a slight increase, but the rapid surge in aluminum prices to 22,000 yuan/mt dampened purchase willingness. Die-casting enterprises with inventories focused on digesting stocks, slowing their procurement pace, while those with low inventories maintained essential restocking, supporting baseline market demand. Supply side, the operating rate of leading secondary aluminum enterprises rose 1.5 percentage points WoW to 60.6%, mainly due to order growth at large sample plants. However, the industry overall remained constrained by insufficient raw material supply, limiting capacity release. Furthermore, high aluminum prices intensified fear of high prices, making some die-casting plants more cautious in procurement and leading to reduced orders for alloy plants. In the import market, the current overseas ADC12 quotation range is $2,600-$2,620/mt. As domestic spot prices rose rapidly to 20,800-21,000 yuan/mt, coupled with a stronger RMB, the immediate import loss narrowed to near the break-even line. Overall, ADC12 prices are expected to hold up well in the short term. Cost support remains relatively solid, and the tight supply of aluminum scrap is unlikely to ease soon, making raw material prices more likely to rise than fall. Demand side shows some resilience, and coupled with low industry inventories, just-in-time procurement will provide a floor for prices. However, with current aluminum prices at yearly highs, downstream acceptance has declined, potentially limiting further upside room.

![Aluminum Scrap Prices Follow Upward Trend but with Regional Divergence Market Supply Increases [SMM Cast Aluminum Alloy Morning Comment]](https://imgqn.smm.cn/usercenter/wStpx20251217171650.jpg)